unemployment benefits tax refund

You would be refunded the income taxes you paid on 10200. The federal tax code counts.

Dwd Will Collect Unemployment Overpayments From Tax Refunds

In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money.

. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. File 2020 Tax Return. File 2021 Tax Return.

Dont expect a refund for unemployment benefits. The American Rescue Plan pandemic relief bill switched up the law so that people who collected unemployment in 2020 could exclude up to 10200 of unemployment payments. Search 3 social services programs to assist you.

Tax refunds on unemployment benefits to start in May. File 2017 Tax Return. File 2019 Tax Return.

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax. When you are applying for SSDI benefits it is typically implied that you are unable to work in any capacity due to an injury or disability you may have suffered. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

With few exceptions all income that you received during the year must be taken into account when determining eligibility. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. File 2016 Tax Return.

You would be refunded the income taxes you paid on 10200. This is the fourth round of refunds related to the unemployment compensation. We will begin paying ANCHOR benefits in the late Spring of 2023.

Can you get a tax refund from unemployment. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. File 2018 Tax Return. Tax Preparation 4 Financial Assistance - All 654 Help Pay For Childcare 15 Help.

However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax. This includes income that you do. Unemployment benefits programs and help in Piscataway NJ.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. Any unemployment income over 10200 is still taxable. Keep in mind you arent going to get 10200 refunded.

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Will My Unemployment Benefits Affect My Tax Refund Gudorf Tax

The Irs Will Refund Those Who Overpaid Taxes On Unemployment Benefits

Asked And Answered Filing Taxes While On Unemployment

Irs Starts Refunds For Tax Returns Claiming Unemployment Benefits Accounting Today

Irs Will Recalculate Taxes On 2020 Unemployment Benefits

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

Here S Why Another Tax Break On Unemployment Benefits Is Unlikely

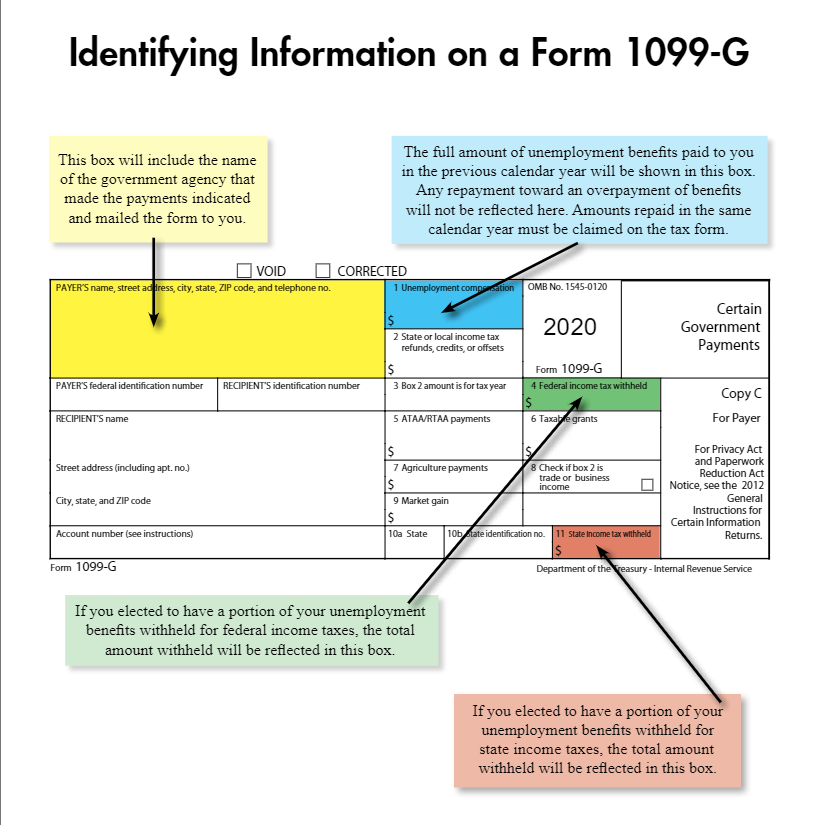

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com

Tax Day 2021 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

What Is A Form 1099 G Thomas Company

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace